Hong Kong stands as a vibrant global financial hub and a strategic gateway to Mainland China and the broader Asian market. Its robust legal system, pro-business environment, and attractive tax policies make it an ideal jurisdiction for international company formation. Establishing a company in Hong Kong offers unparalleled opportunities for growth, asset protection, and streamlined global operations. We specialize in navigating the intricacies of Hong Kong's corporate landscape, ensuring your business is set up efficiently and in full compliance with local regulations, providing a solid foundation for your international ventures.

Hong Kong's appeal as a premier business destination stems from several compelling factors. Its territorial tax system means only profits sourced within Hong Kong are taxed, offering significant tax advantages for international businesses. The city boasts a stable political and economic environment underpinned by a common law legal system, ensuring predictability and security. As a major international financial center, Hong Kong provides access to world-class banking and financial services.

Its proximity and unique relationship with Mainland China (via CEPA) offer unparalleled access to one of the world's largest consumer markets. Furthermore, the ease of doing business, minimal bureaucratic hurdles, and a highly skilled workforce make Hong Kong an efficient and attractive choice for entrepreneurs and corporations looking to expand their global footprint.

Hong Kong operates a territorial tax system, meaning only profits derived from Hong Kong are subject to tax. There is no VAT, capital gains tax, or withholding tax on dividends and interest, making it highly attractive for international businesses.

Strategically located, Hong Kong serves as a crucial bridge to Mainland China and the dynamic Asian markets. Its free port status and robust logistics infrastructure facilitate seamless global trade and investment.

Recognized globally for its business-friendly environment, Hong Kong offers a straightforward company incorporation process, minimal government intervention, and a transparent regulatory framework.

Based on English common law, Hong Kong's legal system is independent and highly respected, providing strong protection for intellectual property rights and ensuring a fair and predictable business environment.

Foreigners can enjoy 100% ownership of their Hong Kong companies, offering full control and flexibility without the need for local partners or resident directors/shareholders (though a local company secretary is required).

Hong Kong boasts advanced financial, communication, and transportation infrastructure, supporting efficient operations for businesses of all sizes and facilitating global connectivity.

Hong Kong offers a unique blend of benefits for international businesses seeking efficiency, growth, and stability.

Select the optimal structure for your business objectives:

| Entity Type | Key Features | Best For |

|---|---|---|

| Private Limited Company | Most common, separate legal entity, limited liability for shareholders, min. 1 director/shareholder. | General trading, holding companies, international investments, small to medium-sized businesses. |

| Sole Proprietorship | Simplest structure, owned by one individual, unlimited personal liability. | Small businesses, freelancers, consultants with low risk. |

| Partnership | Two or more individuals/entities, unlimited liability (General Partnership), or limited liability for some (Limited Partnership). | Joint ventures, professional practices (e.g., law firms, accounting firms). |

| Branch Office | Extension of an overseas parent company, not a separate legal entity, parent company bears full liability. | Foreign companies expanding operations without creating a new legal entity. |

| Representative Office | Limited to liaison, marketing, and research activities; cannot engage in profit-making. | Market research, initial presence, not for direct business operations. |

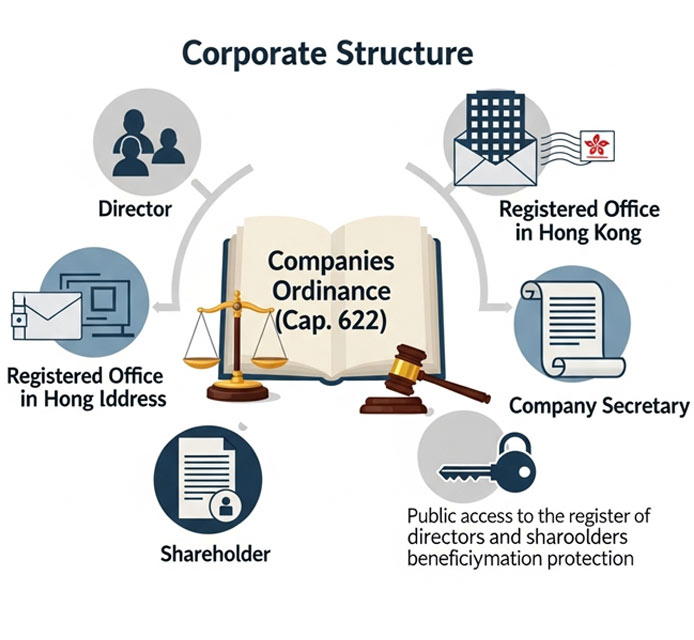

The primary legislation governing companies in Hong Kong is the Companies Ordinance (Cap. 622), a modern and comprehensive law designed to enhance corporate governance and facilitate business. Hong Kong's legal system is based on common law, providing a robust and predictable framework for commercial activities.

A typical Hong Kong Private Limited Company requires at least one director (who can be an individual or a corporate entity, and does not need to be a Hong Kong resident), at least one shareholder (can be the same person as the director, and also not required to be a resident), and a company secretary. The company secretary must be a Hong Kong resident individual or a corporate body with a registered office in Hong Kong. This role is crucial for ensuring compliance with statutory requirements. Every company must also maintain a registered office address in Hong Kong, which is where official documents and notices are served. There is no public register of beneficial owners, offering a degree of privacy, though the Companies Registry maintains records of directors and shareholders which are accessible to the public.

Establishing your Hong Kong company follows a clear and efficient step-by-step process

Begin by selecting your desired company name(s) and conducting a preliminary search with the Hong Kong Companies Registry to ensure availability. Concurrently, prepare the necessary incorporation documents, including the Incorporation Form (Form NNC1) and the company's Articles of Association. These documents outline the company's structure, purpose, and operational rules.

Once all documents are prepared and reviewed, they are formally submitted to the Hong Kong Companies Registry. This can be done electronically via the e-Services Portal for a faster process, or through traditional hard-copy submission. This step initiates the official incorporation process with the authorities.

Upon successful processing and approval by the Companies Registry, you will receive the Certificate of Incorporation, which legally establishes your company. Simultaneously, the Business Registration Certificate is issued by the Inland Revenue Department, a mandatory requirement for all businesses operating in Hong Kong.

Following incorporation, essential post-setup steps include preparing the company's statutory books (e.g., registers of directors and shareholders), issuing share certificates, and appointing a qualified company secretary and registered office. We also assist with opening a corporate bank account and ensuring initial compliance requirements are met, setting your business up for immediate operation.

To comply with Hong Kong's Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, specific documentation is required for all individuals and corporate entities involved in the company formation process. This ensures transparency and legal compliance.

Our team will provide comprehensive guidance on the exact documentation needed and assist with the proper certification and submission to ensure a smooth and compliant process.

Maintaining good standing for a Hong Kong company involves adherence to specific annual compliance obligations. The key requirements include filing an Annual Return (Form NAR1) with the Companies Registry within 42 days after the anniversary of incorporation. This form updates the registry on the company's directors, shareholders, and registered office.

Additionally, the Business Registration Certificate must be renewed annually or every three years with the Inland Revenue Department (IRD). For most limited companies, it is mandatory to prepare audited financial statements annually and file a Profits Tax Return with the IRD. Hong Kong operates a territorial tax system, meaning only profits arising in or derived from Hong Kong are taxable. Companies must also maintain proper accounting records for at least seven years. Furthermore, every Hong Kong company must appoint a local company secretary and maintain a registered office in Hong Kong. Our services include assisting with all these ongoing compliance aspects, ensuring your Hong Kong company remains fully compliant and operational, allowing you to focus on your core business activities.

We offer competitive and transparent pricing for Hong Kong company formation and ongoing services. Our packages are designed to provide comprehensive solutions tailored to various business needs.

Starting from

Starting from

Starting from

*Prices are indicative and may vary based on specific requirements, share capital, and additional services. Government fees (e.g., Business Registration Certificate renewal, Annual Return filing fees) are separate and subject to change. Annual renewal fees apply for ongoing services. Please contact us for a personalized quote.

Our team of experts is ready to assist you. Please fill out the form below with your details and specific needs, and we will contact you promptly to discuss how we can help achieve your global business objectives.

The most common and recommended type of company in Hong Kong is the Private Limited Company. It offers limited liability to its shareholders, meaning their personal assets are protected from business debts. This structure is versatile and suitable for a wide range of business activities, from trading to holding investments.

The incorporation process in Hong Kong is highly efficient. Typically, once all required documents and information are provided, a new company can be incorporated within 1 to 5 business days, especially when using the Companies Registry's e-Services Portal. This quick turnaround makes Hong Kong an attractive jurisdiction for fast business setup.

No, there is no requirement for directors or shareholders to be Hong Kong residents. A Hong Kong Private Limited Company can have 100% foreign ownership. However, it is mandatory to appoint a local company secretary who must be a Hong Kong resident individual or a corporate entity with a registered office in Hong Kong.

Annual compliance includes filing an Annual Return (Form NAR1) with the Companies Registry, renewing the Business Registration Certificate, and filing a Profits Tax Return with the Inland Revenue Department (IRD). Most limited companies also need to prepare audited financial statements annually. Maintaining proper accounting records and a registered office is also mandatory.

No, Hong Kong operates under a territorial source principle of taxation. This means that only profits arising in or derived from a trade, profession, or business carried on in Hong Kong are subject to Profits Tax. Income generated outside Hong Kong, even if remitted to Hong Kong, is generally not taxed, making it highly attractive for offshore businesses.