The United Arab Emirates has emerged as a global business hub, attracting entrepreneurs and investors worldwide with its strategic location, robust infrastructure, and business-friendly policies. Establishing a company in the UAE offers unparalleled opportunities for growth, access to international markets, and a highly attractive tax environment.

Whether you choose a Free Zone, Mainland, or Offshore setup, the UAE provides a dynamic ecosystem for diverse business activities. Our expertise ensures a seamless company formation process, adhering to all local regulations while maximizing the significant advantages available to your enterprise, setting a strong foundation for your global success.

The UAE stands out as a premier destination for business due to its exceptional economic stability, strategic geographical position connecting East and West, and a progressive vision for innovation and development. The country offers a highly attractive tax regime, including 0% corporate and personal income tax in many free zones, making it a lucrative environment for profit maximization. Its world-class infrastructure, including state-of-the-art airports, seaports, and digital connectivity, facilitates seamless global trade and logistics.

Furthermore, the UAE boasts a diverse and multicultural workforce, a secure living environment, and a government committed to fostering business growth through streamlined regulations and investor-friendly policies. Choosing the UAE means positioning your business in a thriving, globally connected economy with immense potential for expansion and success.

Benefit from a highly favorable tax environment, with 0% corporate and personal income tax in many free zones, and a competitive corporate tax rate in the mainland, maximizing your business profitability.

Leverage the UAE's unparalleled geographical location, serving as a gateway between East and West, providing easy access to emerging markets and global trade routes.

Operate within a modern and advanced infrastructure, including state-of-the-art logistics, telecommunications, and transportation networks, supporting seamless business operations.

Choose from a wide array of business structures, including various free zones offering specific industry clusters and 100% foreign ownership, catering to diverse business needs.

Benefit from a politically stable and economically robust environment, coupled with a high level of security and safety, fostering confidence for long-term investments.

Experience streamlined processes for company registration, licensing, and visa acquisition, supported by a government committed to simplifying business setup and operations.

The United Arab Emirates offers a multitude of benefits for businesses looking to establish a strong presence in the Middle East and beyond.

Select the optimal structure for your business objectives in the UAE:

| Entity Type | Key Features | Best For |

|---|---|---|

| Free Zone Company (FZCO/FZE) | 100% foreign ownership, 0% corporate/personal tax, duty-free imports, specific industry focus | International trade, consulting, e-commerce, specific industries within free zones |

| Mainland Company (LLC) | Ability to trade anywhere in UAE, local market access, wider range of activities | Local market operations, retail, services, contracting, joint ventures with local partners |

| Offshore Company | No physical presence, 0% tax, asset protection, international operations only | Holding companies, international consulting, asset protection, intellectual property ownership |

| Branch Office | Extension of foreign parent company, no separate legal identity | Foreign companies seeking to establish a presence without full incorporation |

| Representative Office | Limited to marketing and promotional activities, no direct sales | Market research, liaison activities for foreign companies |

| Sole Proprietorship | Owned by one individual, unlimited liability | Small businesses, professional services by individuals |

| Civil Company | Partnership for professionals (e.g., doctors, lawyers) | Professional practices, joint ventures among professionals |

The UAE's legal framework for company formation is dynamic and continuously evolving to support its position as a global business hub. The primary legislation governing mainland companies is the UAE Commercial Companies Law (Federal Decree-Law No. 32 of 2021 on Commercial Companies), which allows for 100% foreign ownership in most sectors. Free zones, on the other hand, operate under their own distinct regulations, offering specific benefits like full foreign ownership, 0% corporate tax, and customs duty exemptions, governed by their respective Free Zone Authorities.

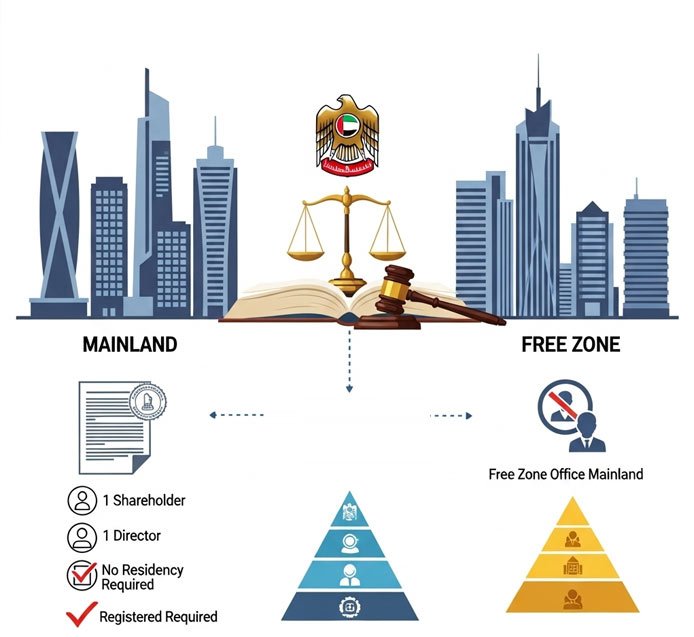

A typical UAE company structure varies based on the chosen entity type. For instance, a Mainland Limited Liability Company (LLC) generally requires a minimum of one shareholder and one director, with no nationality restrictions. Free Zone companies also typically require one shareholder and one director, who can be individuals or corporate entities, and do not need to be UAE residents. While public registers exist for certain company details, the level of transparency and privacy can differ between mainland and free zone setups. A registered office and a local sponsor (for mainland companies in some cases, though 100% foreign ownership is now common) are mandatory. Our team provides comprehensive guidance on navigating these legal requirements, ensuring your company is established in full compliance with UAE laws.

Establishing your UAE company follows a clear and efficient step-by-step process

Begin by defining your primary business activities and choosing the most suitable jurisdiction—Mainland or a specific Free Zone. This decision impacts licensing, ownership structure, and operational scope. Simultaneously, submit preliminary documents for initial approval, which typically includes passport copies and a proposed company name. Our team will assist in selecting the ideal setup and ensuring compliance with initial regulatory checks.

Once your business activity and jurisdiction are confirmed, we proceed with reserving your preferred company name with the relevant authority (Department of Economic Development for Mainland or the respective Free Zone Authority). Following name approval, we secure the initial approval for your business setup, which is a crucial step allowing you to proceed with further documentation and licensing.

With initial approvals in hand, we prepare all necessary legal documents, including the Memorandum and Articles of Association, lease agreements for office space (if required), and any other supporting documents. These are then submitted to the relevant licensing authority. Upon successful review, your trade license is issued, officially allowing your company to operate in the UAE.

After obtaining your trade license, we assist with visa processing for shareholders, directors, and employees, including residence visas and Emirates IDs. Concurrently, we guide you through the process of opening a corporate bank account with a local or international bank in the UAE. These final steps ensure your company is fully operational and compliant, ready to conduct business seamlessly in the Emirates.

To comply with stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations in the UAE, specific documentation is required for all individuals and corporate entities involved in the company formation process. This ensures full transparency and legal adherence.

Please note that specific requirements may vary based on the chosen jurisdiction (Mainland vs. Free Zone) and the nature of your business activity. Our consultants will provide a precise list tailored to your needs and assist with the proper attestation and submission of all required documents.

Maintaining compliance in the UAE is crucial for the long-term success and good standing of your company. While the UAE offers a business-friendly environment, adherence to ongoing regulatory requirements is essential. Key obligations include the annual renewal of your trade license, which ensures your company's legal right to operate. This renewal process involves submitting updated documents and paying the relevant government fees, which vary depending on the jurisdiction (Mainland or Free Zone) and the type of license.

Additionally, all UAE companies are required to maintain proper accounting records and comply with VAT regulations (if applicable). Although many free zone companies benefit from 0% corporate tax, they are still required to file annual audited financial statements with their respective Free Zone Authority. Mainland companies are subject to corporate tax and must file tax returns with the Federal Tax Authority. Companies must also ensure compliance with economic substance regulations (ESR) if they conduct relevant activities. Our comprehensive services include assisting with license renewals, accounting and auditing support, VAT registration and filing, and ensuring adherence to all other ongoing compliance mandates, allowing you to focus on your core business activities.

We offer transparent and competitive pricing for company formation and ongoing services in the United Arab Emirates. Our packages are designed to provide comprehensive solutions tailored to various business needs, from basic setup to premium support.

Starting from

Starting from

Starting from

*Prices are indicative and may vary based on specific requirements, chosen free zone/mainland authority, and additional services. Annual renewal fees apply for ongoing services. Please contact us for a personalized quote.

Our team of experts is ready to assist you. Please fill out the form below with your details and specific needs, and we will contact you promptly to discuss how we can help achieve your global business objectives.

The main types of companies in the UAE are Mainland companies, Free Zone companies, and Offshore companies. Mainland companies can trade directly with the local market, while Free Zone companies offer 100% foreign ownership and tax exemptions within designated free zones. Offshore companies are primarily for international business and asset protection, with no local trading.

The time frame for company registration in the UAE varies depending on the chosen jurisdiction and business activity. Generally, a Free Zone company can be set up within 2 to 7 business days, while a Mainland company might take 7 to 14 business days, assuming all documents are in order and approvals are swift. Our team works to expedite the process as much as possible.

Yes, 100% foreign ownership is allowed for companies established in any of the UAE's numerous Free Zones. Additionally, with recent amendments to the UAE Commercial Companies Law, 100% foreign ownership is now permitted for most business activities on the Mainland, eliminating the previous requirement for a local sponsor in many sectors.

The UAE introduced a federal corporate tax of 9% on taxable profits exceeding AED 375,000 effective from June 1, 2023. However, Free Zone companies that meet specific criteria (e.g., maintaining adequate substance and not deriving income from mainland UAE) can still benefit from a 0% corporate tax rate. There is generally no personal income tax in the UAE.

For most Mainland companies, a physical office space is a requirement for licensing. For Free Zone companies, the requirement for a physical office varies by free zone and license type; some offer flexi-desk or virtual office options, while others require a dedicated physical space. Our consultants can advise on the specific requirements for your chosen setup.