Mauritius has emerged as a highly attractive jurisdiction for international business, offering a sophisticated and well-regulated environment for company formation. Strategically located between Africa and Asia, it serves as an ideal platform for global investment and trade. The island nation boasts a robust legal framework, a competitive tax regime, and an extensive network of Double Taxation Avoidance Agreements (DTAAs), making it particularly appealing for cross-border transactions and wealth management.

Establishing a company in Mauritius provides a stable and reputable foundation for diverse international activities, including holding structures, investment funds, and regional headquarters. Our expertise ensures seamless compliance with local regulations while maximizing the significant advantages Mauritius offers for your global ventures.

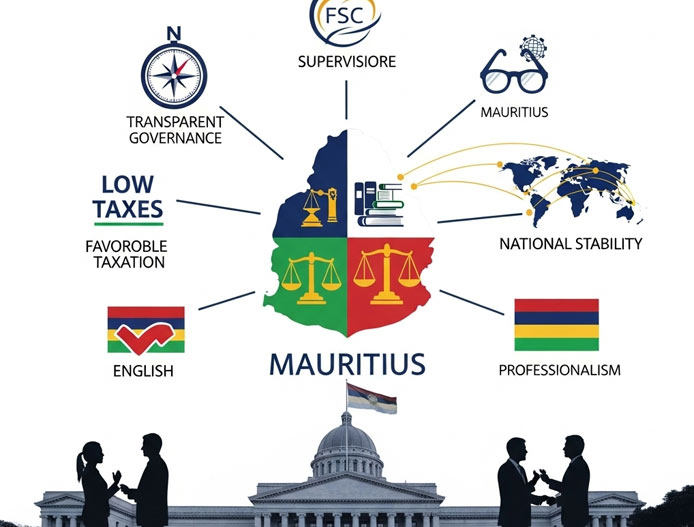

Mauritius stands out as a preferred international financial center due to its unique blend of attributes. Its hybrid legal system, combining English common law and French civil law, provides a familiar and robust framework. The country's commitment to good governance and adherence to international best practices in financial regulation, overseen by the Financial Services Commission (FSC), ensures a high level of credibility and investor confidence.

A key differentiator is its vast network of DTAAs with over 40 countries, facilitating efficient tax planning and reducing withholding taxes for international investors. Furthermore, Mauritius offers a highly competitive corporate tax rate, a skilled bilingual workforce, and a stable political and economic landscape. These factors collectively position Mauritius as an excellent choice for businesses seeking a reputable, efficient, and strategically advantageous base for their global operations, particularly those targeting investments into Africa and Asia.

Positioned as a bridge between Africa and Asia, Mauritius offers unparalleled access to emerging markets and serves as a strategic hub for regional and international business expansion.

Benefit from Mauritius's wide network of Double Taxation Avoidance Agreements (DTAAs) with over 40 countries, optimizing tax efficiency for cross-border investments and income streams.

Mauritius is a well-regulated international financial center, adhering to global standards for transparency and anti-money laundering, ensuring credibility and investor confidence.

Enjoy a competitive corporate tax rate (effective 3% for Global Business Companies meeting substance requirements) and no capital gains tax, making it highly attractive for profit retention and reinvestment.

Access a highly educated and bilingual (English and French) workforce, providing a strong talent pool for various business operations and support services.

Benefit from Mauritius's stable political environment and robust economic growth, providing a secure and predictable foundation for long-term business planning and investment.

Mauritius offers a compelling proposition for international businesses seeking efficiency, stability, and strategic advantages.

Choose the structure that best aligns with your global business objectives:

| Entity Type | Key Features | Best For |

|---|---|---|

| Global Business Company (GBC) | Resident for tax purposes, access to DTAA network, effective 3% tax rate (with substance) | International investments, holding companies, regional headquarters, funds |

| Authorised Company (AC) | Non-resident for tax purposes, no access to DTAAs, minimal substance requirements | Trading, consulting, e-commerce, where DTAA benefits are not required |

| Protected Cell Company (PCC) | Segregated assets and liabilities for each cell, legal protection between cells | Investment funds, insurance, securitization, collective investment schemes |

| Limited Partnership (LP) | Flexible structure, general and limited partners, tax-transparent option | Private equity, venture capital funds, joint ventures |

| Trusts & Foundations | Robust asset protection, estate planning, wealth management, confidentiality | Succession planning, charitable purposes, family wealth preservation |

| Collective Investment Scheme (CIS) | Regulated investment vehicles for pooling investor funds | Mutual funds, hedge funds, private equity funds |

| Global Headquarters Administration (GHA) | Specific license for multinational companies establishing regional HQs | Large multinational corporations managing regional operations |

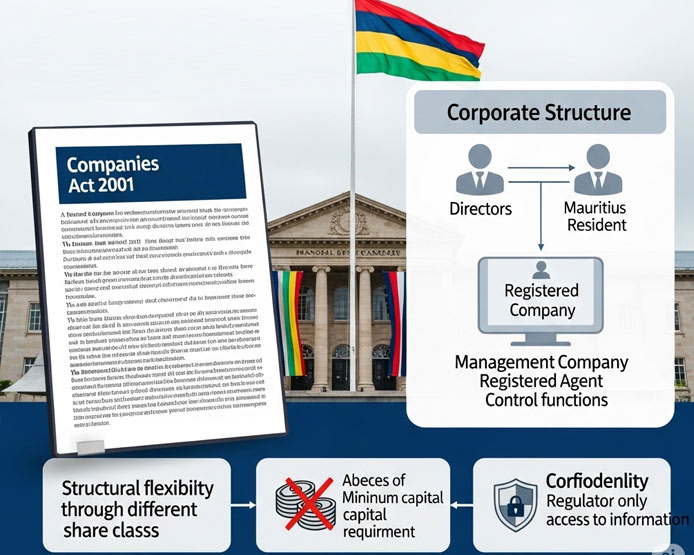

The corporate landscape in Mauritius is primarily governed by the Companies Act 2001 and the Financial Services Act 2007, both of which are regularly updated to align with international best practices and maintain the jurisdiction's competitive edge. The Financial Services Commission (FSC) is the integrated regulator for the non-bank financial services sector and global business, ensuring robust oversight and compliance.

A key aspect of Mauritius company formation, particularly for Global Business Companies (GBCs), is the requirement to appoint a licensed management company to act as the registered agent. This ensures adherence to local regulations and provides essential administrative support. A GBC must have at least two directors, who can be individuals or corporate entities, and at least one director must be resident in Mauritius to satisfy substance requirements and benefit from the DTAA network. While there is no public register of beneficial owners, information is accessible to regulatory authorities. The structure is flexible, allowing for various share classes and no minimum capital requirement for most entities, making it adaptable to diverse business models.

Establishing your Mauritius company follows a clear and efficient step-by-step process, ensuring regulatory compliance and swift setup.

We begin with a comprehensive consultation to understand your business needs and recommend the most suitable Mauritius entity type. Concurrently, we collect all necessary Know Your Customer (KYC) documents for all beneficial owners, directors, and shareholders. This includes certified copies of passports, proof of address, and professional references, ensuring full compliance with international Anti-Money Laundering (AML) regulations.

Once due diligence is approved, we proceed with reserving your preferred company name with the Registrar of Companies. Simultaneously, we prepare all foundational corporate documents, including the Memorandum and Articles of Association, which define your company's operational framework and governance. These documents are meticulously drafted to meet Mauritius legal requirements.

For Global Business Companies (GBCs) or Authorised Companies (ACs), an application for a license is submitted to the Financial Services Commission (FSC). Upon approval by the FSC and the Registrar of Companies, the Certificate of Incorporation is issued, officially bringing your Mauritius company into legal existence. This step confirms your company's registration and licensing to operate internationally.

After successful incorporation, we provide you with a complete set of corporate documents, including the Certificate of Incorporation, Memorandum and Articles of Association, and registers of directors and shareholders. We also assist with essential post-incorporation services such as opening corporate bank accounts, arranging for local directors (if required), and ensuring ongoing compliance with annual filing and substance requirements.

To ensure compliance with international Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, specific documentation is required for all individuals and corporate entities involved in Mauritius company formation. This ensures transparency and legal adherence.

Our team will provide detailed guidance and support to ensure all documentation is correctly prepared, certified, and submitted, facilitating a smooth and efficient incorporation process in Mauritius.

Maintaining good standing for a Mauritius company involves adherence to specific ongoing compliance requirements. For Global Business Companies (GBCs), this includes filing annual audited financial statements with the Financial Services Commission (FSC) and the Registrar of Companies. GBCs are also required to demonstrate sufficient substance in Mauritius, which typically involves having at least two local directors, maintaining adequate expenditure, and having physical office space or employing staff in Mauritius, commensurate with their activities.

Authorised Companies (ACs), while having fewer substance requirements, must still file an annual return with the Registrar of Companies and ensure their activities are primarily conducted outside Mauritius. All Mauritius companies must maintain a registered office and a licensed management company in Mauritius, which serves as the primary point of contact with regulatory authorities and handles essential administrative tasks. Our comprehensive services include assisting with these annual filings, ensuring substance requirements are met, and providing ongoing advisory to keep your Mauritius entity fully compliant and operational, allowing you to focus on your core business activities.

We offer competitive and transparent pricing for Mauritius company formation and ongoing services. Our packages are designed to provide comprehensive solutions tailored to various business needs, from basic setup to full substance solutions.

Starting from

Starting from

Starting from

*Prices are indicative and may vary based on specific requirements, complexity, and additional services. Annual renewal fees apply for ongoing services. Please contact us for a personalized quote.

Our team of experts is ready to assist you. Please fill out the form below with your details and specific needs, and we will contact you promptly to discuss how we can help achieve your global business objectives.

A Global Business Company (GBC), previously known as a GBL1, is a Mauritian resident company licensed by the Financial Services Commission (FSC) to conduct business primarily outside Mauritius. GBCs are eligible to benefit from Mauritius's extensive network of Double Taxation Avoidance Agreements (DTAAs) and are subject to an effective corporate tax rate of 3% on foreign-sourced income, provided they meet specific substance requirements.

The incorporation process for a Mauritius company, particularly a GBC or Authorised Company, typically takes between 5 to 10 business days, assuming all due diligence documents are complete and approved. This timeframe includes name reservation, filing with the Registrar of Companies, and obtaining the necessary license from the Financial Services Commission (FSC).

While Mauritius is committed to international transparency standards, the register of beneficial owners is generally not publicly accessible. Information is held by the licensed management company and accessible to regulatory authorities upon request. The register of directors is publicly available, but details of individual shareholders are typically not.

Mauritius GBCs are required to file annual audited financial statements with the FSC and the Registrar of Companies. They must also demonstrate sufficient economic substance in Mauritius, which includes having at least two resident directors, maintaining office premises, and incurring adequate operational expenditure in the country. Annual government fees and license renewal fees also apply.

A Global Business Company (GBC) in Mauritius is primarily established for international business activities. While it can conduct some incidental local business, its main operations and income must be derived from outside Mauritius. For significant local business activities, a domestic company would be the more appropriate structure, subject to different regulatory and tax frameworks.