Panama stands as a distinguished global financial hub, renowned for its strategic geographical position, robust banking sector, and a legal framework highly favorable to international business. Establishing a company in Panama offers a dynamic and advantageous platform for a wide spectrum of global activities, including significant benefits such as a territorial tax system and strong asset protection. Our expertise ensures seamless compliance with local regulations, while maximizing the extensive advantages available to your international enterprise, providing a solid and prosperous foundation for your global ventures.

Panama is a premier choice for international business due to its unique blend of strategic advantages. Its territorial tax system means that income generated outside Panama is exempt from local taxation, offering significant tax efficiency for global operations. The nation boasts a high degree of confidentiality and privacy for corporate entities, safeguarding sensitive business information. Panama's stable political and economic environment, coupled with a common law legal system, provides a secure and predictable foundation for corporate ventures.

Furthermore, its world-class banking infrastructure and strategic location as a global trade hub (thanks to the Panama Canal) facilitate seamless international transactions and logistics. Choosing Panama means leveraging a jurisdiction that combines efficiency, privacy, and international connectivity.

Panama operates on a territorial tax basis, meaning that companies are only taxed on income derived from activities conducted within Panama. Foreign-sourced income is exempt from local taxes, providing significant tax advantages for international businesses.

Panama offers a high level of privacy. Information regarding beneficial owners, shareholders, and directors is not publicly disclosed, ensuring discretion for international business affairs and asset protection.

Leveraging the Panama Canal and its position as a major maritime and logistics center, Panama offers unparalleled connectivity for global trade and investment, making it an ideal base for international operations.

Panamanian corporate law is highly flexible, allowing for various company structures with minimal requirements for share capital, director residency, and administrative burdens, facilitating easy incorporation and management.

Panama boasts a well-developed and stable banking system with a wide range of international banks, offering diverse financial services and facilitating global transactions for Panamanian entities.

Panamanian entities, particularly Private Interest Foundations and Corporations, are widely used for sophisticated asset protection strategies, shielding wealth from potential claims, lawsuits, and political or economic instability.

Panama offers unique benefits for international entrepreneurs and investors.

Discover the primary legal structures available in Panama for international business:

| Entity Type | Key Features | Best For |

|---|---|---|

| Sociedad Anónima (Corporation) | Most common, limited liability, flexible structure, minimum 3 directors (can be nominee), minimum 2 shareholders. | General trading, holding companies, international investments, e-commerce. |

| Private Interest Foundation (PIF) | Strong asset protection, estate planning, confidentiality, non-profit but can hold commercial assets. | Wealth management, succession planning, charitable purposes, asset segregation. |

| Limited Liability Company (LLC) | Hybrid structure, limited liability for members, operational flexibility. | Joint ventures, specific business projects, where a corporate structure might be too rigid. |

| Branch Office | Extension of a foreign company, no separate legal entity. | Foreign companies seeking to establish a physical presence and conduct business directly in Panama. |

| Shelf Company | Pre-registered, dormant entity, immediate access. | Quick business commencement, urgent transactions. |

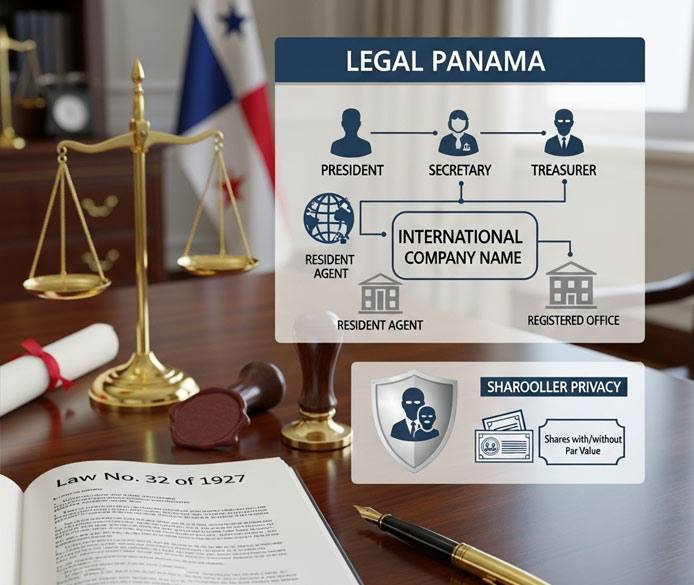

Panama's offshore sector is primarily governed by the Law No. 32 of 1927 for corporations (Sociedad Anónima) and Law No. 25 of 1995 for Private Interest Foundations. These legislations provide a clear and comprehensive framework for the incorporation, operation, and dissolution of Panamanian entities. The legal system is designed to foster international trade and investment by offering a business-friendly environment with minimal regulatory hurdles for offshore activities.

A typical Panamanian Sociedad Anónima (Corporation) requires a minimum of three directors (President, Secretary, Treasurer) and two shareholders. Directors can be individuals or corporate entities, and do not need to be residents of Panama. While their names are registered in the Public Registry, shareholder information is generally not public, ensuring a high degree of privacy. A resident agent, who must be a Panamanian lawyer or law firm, and a registered office in Panama are mandatory. These services ensure compliance with local regulations without requiring a physical presence from the client. Panama's legal framework also allows for the issuance of shares with or without par value, providing further structural versatility.

Establishing your Panamanian company follows a clear and efficient step-by-step process

Begin by providing your preferred company name for a preliminary availability check with the Public Registry. Simultaneously, submit the necessary due diligence documents for all beneficial owners, directors, and shareholders. This typically includes certified passport copies and proof of residential address, adhering to international Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. Our team will meticulously review these documents to ensure full compliance before proceeding.

Once your chosen company name is approved and all due diligence requirements are satisfied, we will draft the Articles of Incorporation (Pacto Social). This foundational document outlines your company's name, purpose, capital, duration, and governance structure. It must then be notarized by a Panamanian Public Notary, a crucial legal step for formal recognition.

Following notarization, the Public Deed containing the Articles of Incorporation is submitted to the Panamanian Public Registry. This official registration process ensures that your company is legally recognized and recorded in Panama. This step formally establishes your company's legal existence.

Upon successful registration, the Public Registry issues the Certificate of Incorporation, which serves as legal proof of your company's formation. We will then provide you with a complete set of essential corporate documents, including the original Public Deed, share certificates, and registers of directors and shareholders. We also assist with any immediate post-incorporation needs, such as setting up a corporate bank account or arranging for nominee services, ensuring a smooth transition into your business activities.

To comply with international Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, specific documentation is required for all individuals and corporate entities involved in Panama company formation. This ensures transparency and legal compliance.

We will provide detailed guidance on the exact requirements and assist with the proper certification and submission of all necessary documentation to ensure a seamless process.

While Panamanian companies, especially those operating offshore, are known for their streamlined compliance, it is crucial to adhere to specific annual obligations to maintain good standing. The primary requirement for a Panamanian corporation (Sociedad Anónima) is the payment of the annual flat tax (tasa única), which ensures the company's continued registration with the Public Registry. This tax is due annually on the anniversary of the company's incorporation. Failure to pay can result in penalties and, ultimately, the suspension or striking off of the company.

Every Panamanian company must maintain a registered office and a resident agent within Panama. Our firm provides these essential services, acting as your local point of contact and ensuring all official communications are handled promptly and correctly. For companies deriving income solely from outside Panama, there is generally no requirement to file annual financial statements or income tax returns in Panama, simplifying ongoing administration significantly. However, it is prudent for the company to maintain proper accounting records internally to reflect its financial position accurately. These records should be kept at the registered office or another designated location. Our team assists with these ongoing maintenance aspects, ensuring your Panamanian company remains fully compliant and operational.

We offer competitive and transparent pricing for Panama company formation and ongoing services. Our packages are designed to provide comprehensive solutions tailored to various business needs.

Starting from

Starting from

Starting from

*Prices are indicative and may vary based on specific requirements and additional services. Annual renewal fees apply for ongoing services. Please contact us for a personalized quote.

Our team of experts is ready to assist you. Please fill out the form below with your details and specific needs, and we will contact you promptly to discuss how we can help achieve your global business objectives.

A Panamanian Sociedad Anónima (S.A.) is the most common legal entity incorporated under Panama's corporate laws, primarily for international business activities. It offers limited liability to its shareholders and is typically exempt from local taxes on income generated outside Panama due to its territorial tax system. S.A.s are ideal for global trading, holding companies, and various international investment strategies, known for their flexible structure and privacy provisions.

The incorporation process for a Panamanian company is generally efficient. Typically, once all required due diligence documents are received and the Articles of Incorporation are notarized, the registration with the Public Registry can be completed within 3 to 7 business days. This quick turnaround is a key advantage of choosing Panama, allowing businesses to establish their international presence swiftly.

Panama maintains a high level of confidentiality. While the names of the directors of a Sociedad Anónima are registered in the Public Registry, information regarding beneficial owners and shareholders is generally not publicly accessible. Panama's legal framework emphasizes privacy, making it an attractive jurisdiction for those seeking discretion in their corporate structures.

The main annual maintenance requirement for a Panamanian company (Sociedad Anónima) is the payment of the annual flat tax (tasa única) to the Public Registry. Additionally, the company must maintain a registered office and a resident agent in Panama. For companies with foreign-sourced income, there is generally no requirement to file annual financial statements or income tax returns in Panama, simplifying ongoing administration.

A Panamanian company, particularly an offshore one, is generally intended for international business activities. If a company wishes to conduct business within Panama (e.g., engage in local trade, own real estate in Panama, or employ local staff), it will need to obtain specific local licenses and permits and will be subject to Panamanian income tax on locally generated income. For purely offshore activities, local business conduct is restricted.

A Panamanian Private Interest Foundation (PIF) is a unique legal entity established under Law No. 25 of 1995, combining features of both trusts and corporations. It is primarily used for asset protection, estate planning, and wealth management. PIFs offer significant confidentiality, are exempt from most local taxes on foreign income, and allow for the segregation of assets from the founder's personal estate, providing robust protection against creditors and lawsuits. They are managed by a Foundation Council and operate according to a private Foundation Regulation.